As President and Broker

of River Valley Real Estate Company as well as private investor in real estate,

I learned very early in the business that truly great purchase opportunities do

not often simply fall out of the sky.

More often than not, these deals are found through diligent research and

hard work. Constant market evaluation is

critical to achieving success in real estate, and this requirement relates to

Realtors, investors and home owners alike.

When evaluating a real

estate market, what factors are considered most important? First and foremost are supply and

demand. With regard to a residential

real estate market, supply would refer to the number of homes currently

available for sale on the open market, and demand would be measured by the

number of residential properties sold and closed during the most recent historical

time period. Further insight into demand

would be an evaluation of several historical time periods to identify

continuing trends. These two variables dictate most all market trends. Increases and decreases in prices are

directly related to supply and demand. As

are marketing times, which are commonly referred to as “days on market” in the

residential Realtor world. There are

external factors such as available financing and interest rates, however, these

factors are not nearly as influential as the basic laws of supply and demand.

Now that I have laid

all of the necessary ground work, let’s take a look at the data collected.

In review of these

first two categories, it should not be surprising that nine zip codes are

contained within both. The price per

square foot correlates closely with the total sales price especially when

evaluating detached single family residences within the San Antonio area.

Tricky analysis here due to the fact that not all zip codes contain similar densities of residential development, so it is unwise to assume that one zip code is preferred over another specifically due to a larger volume of sales. However, it is a good indicator of what zip codes people are choosing to reside within.

As expected, not one zip code listed above was listed in either of the first two groups. As a matter of fact, eight of the ten zip codes with the shortest marketing times have average sales prices below $200,000.00. This is a simple yet strong indicator of the large quantity of buyers within the $200,000 and below price range.

It is of interest to note that of these ten zip codes, only 78248 had an average sales price of $300,000 or greater. Another interesting note pertains to the fact that 78247 ranked #1 in the shortest marketing times and #2 in the most units sold. Additionally, 78249, 78250, 78154 and 78254 were also listed within both the top 10 shortest marketing times and the top ten most units sold. Again, all five of these zip codes had average sales price below $200,000.

So far, I have exposed you to the historical side of the evaluation by looking at the top ten zip codes regarding closed sales over the past five plus months within each category. I would add a quick summarization of the study. With regard to total average sales prices, 12 zip codes had prices of $300,000 or greater, 8 zip codes had sales prices between $299,000 and $200,000 and 20 zip codes had sales prices under $200,000. 16 zip codes had prices per square foot above $100.00, 12 were between $99 and $80 per square foot and the remaining 12 had sales prices per square foot below $79.00. 15 zip codes had 200 or more homes sold. 15 zip codes had between 199 and 100 homes sold, and only 10 zip codes had less than 100 homes sold during the past 5 plus months. Last, 13 zip codes had average marketing times of 80 days or less. 15 zip codes had marketing times between 81 and 99 days. 12 zip codes had marketing times over 100 days with only one area, being 78257, having average marketing times longer than 180 days.

Knowing what happened yesterday is critically important. In this instance, the data accumulated can be evaluated to create a base line for future valuation. This is exactly the information appraisers utilize to determine current fair market value, however, historical data only tells one side off the story. Current listing information, when analyzed correctly, can provide strong insight with regard to future valuations. Again supply and demand are the primary factors, so now I will analyze the active market to draw conclusions about the housing markets near future. The first place to start is existing active inventory.

In reviewing this list, you should have stopped and looked back at the list showing the total number of sales for the past five months. Why? Because the numbers of active listing are decisively smaller. To help you out, I’m going to do a little side by side comparison.

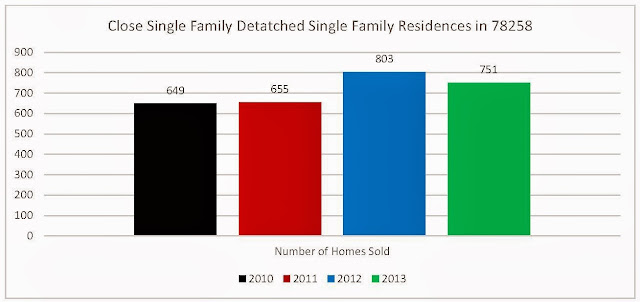

When looking at these two lists side by side, the first thing to note is that the zip code with the largest inventory is 78253 with 284 Active listings. However, during the past 5 months and 5 days, 78253 sold and closed 366 homes. 78258 which has the third most active listings with 230; sold 371 homes during the past five months and five days. 78260 has 217 Active listings but sold 317, and 78109 has 160 active listings but sold 273. This trend clearly identifies decreasing supply.

Let me be the first to say, “Hey wait, you’re looking at asking prices, and people can ask whatever they want”. This is true, but listings in the MLS system are represented by Realtors. Realtors by their very nature want a property priced correctly with regard to current market value, so it will sell within a reasonable amount of time. It would be a false assumption to dismiss these rising asking prices on the basis that sellers are simply asking outrageous prices. The most viable assumption would be that the decreasing inventory coupled with sustained demand is causing prices to increase, and increasing they are in dramatic fashion. As I mentioned at the beginning of the article, increases in price should be tempered with a 5% to 10% variance. Most historical sales analyzed sold within 5% to 10% of their original list price. I will account for this factor in the final top ten list, but for now, let’s see how much asking prices has eclipsed past selling prices. From the Top 10 Sales prices per square foot list, the high was $182.85 followed by $169.01 and 150.89 respectively. Comparing the current asking prices to the past sales, the top three sales would rank #6, #7 and #9. Additionally, #5 through #10 from the Top 10 sales prices per square foot would not even make the Top 10 list for current asking prices.

My final Top 10 List looks at the Percentage Increase between the Sales Price per square foot and the Current List Price per square foot.

The first point I want to stress is that these increases are based from statistical data collected over the past 5 months and 5 days. Secondly, I would ask you to note the adjusted column where 10% was subtracted to account for the discrepancies between Original List Prices and Actual Sales Prices. So, after considering these two factors, the escalation in prices is most promising. Actually, they warrant celebration that is unless you are looking to buy. Truth be told, the absolute best time to purchase is during the beginning of an upswing in a market.

In closing, I would stand confident in proclaiming our markets within the northern central portion of the Greater San Antonio area to be steadily improving. With mortgage rates remaining fairly stable, this trend should continue through 2014. We should expect to see homes continuing to be placed on the market, new construction to increase as well as new future development. We will also experience a continued increase in demand as people choose to move to the area, and first time home buyers enter the market. As always is the case, our military service families will continue to purchase while stationed here and call San Antonio home.

Analysis done and written by: Bill Barkley