At some point in your life, you will face this dilemma. For many, this will be the largest purchase of their lifetime. There are so many important questions to ask, and an equal amount of advice to be received. I am a very strong believer in property ownership, however, such fits my lifestyle and long term needs. For the purposes of this blog, I am choosing not to discuss the pros and cons of long term home ownership. First, I do not think there is a favorable argument against it unless you live in Los Angeles or New York City where price becomes a major obstacle. Second, I personally feel those in for short term are the ones needing sound advice.

Who makes up the group considering their first home or a short term home purchase? Obviously, it includes the first time home buyer. Additionally, it includes the short term home buying group which comprises those with temporary employment transfers, military members considering purchasing during a three year change of station, students, and the investment property flipper. I selected the first four groups because more than likely they will be looking to sell within 3 to 5 years or even sooner. The last group must sell almost immediately to make a profit on the deal especially if the purchase includes financing. I will not dive into investment purchasing strategies today, but I will utilize some of their investment parameters as examples and guidelines for the other groups.

To begin, let’s all agree that price is a product of the two most basic economic principles being supply and demand. In this case, SUPPLY will refer to the number of comparable homes available for sale within the immediate and competitive neighborhoods. DEMAND will refer to the number of active qualified purchasers within that set of parameters. As Realtors, supply is easy to determine by utilizing our membership in the local MLS system. Demand, on the other hand, can only be judged by historical information such as recent comparable sales data. It is critical to understand the premise that when supply is decreasing while demand is constant or increasing, prices will rise. Many of us as Realtors have witnessed multiple buyers for the same property with a bidding war ensuing to purchase the property. Likewise, when there is a steady or increasing number of homes on the market with a constant or diminishing number of qualified purchasers, prices will tend to fall. Buyers will often offer less than the actual asking price for the house, and Seller’s will continue to reduce the price of their property until they reach a price to attract a purchaser. Understanding these simple principles, is the first step in answering the question of whether to rent or buy.

As a first time home buyer or a member of the military going through a change of station, many will be confronted with the allure to purchase a new home because of favorable financing products with minimal to zero money required for a down payment, and seller concessions such as paying all or part of the buyer’s closing costs, low maintenance and the warranty that goes along with a new home purchase. The opportunity to move into a new home at virtually no cost for the first 30 to 60 days is attractive to say the least. This is especially true when compared to the prospect of renting a home which requires application fees, a security deposit, first month’s rent and a required pet deposit for the other member of the family. Depending on the monthly rental rate, this can become a substantial amount, and pales in comparison to the previously mentioned scenario. However, as attractive as the front end of the purchase looks, just like the investment house flipper, you have to consider and plan your exit strategy. I would note that you do not see many investment house flippers purchasing in new developments. This is because they cannot compete with the new construction and pricing in the short term. The same scenario exists in markets where the prices of existing homes are falling. The key point to remember when buying in the short term is to make the best possible purchase in the area with the highest demand and lowest inventory. Also, make sure the demand in that area is constant, and not just a recent one time trend. You will pay more, but it will be because there is true sustainable value.

For residential purchase to be considered a financial success, you must have appreciation which is to say prices must increase during the term of your ownership. To sell a residence with a Realtor representing your interests at market rates, you can expect to incur seller expenses of approximately 8% of the sales price. If you are asked to cover the buyer’s closing expenses this number could swell to between 10% and 12% of the sales price. So the needed appreciation on the property during your ownership will have to equate to somewhere between 3% and 4% per year. For example: you purchase a home in 2014 for $200,000.00. You need to sell the house in 2017, and your equity position due to the lack of a required down payment is 5% or less being approximately $10,000.00, meaning you owe $190,000.00 on the house. At your original purchase price, your anticipated Seller closing costs will range between $16,000.00 and $24,000.00. Therefore, you will need to sell the home at a price upwards of $220,000.00 just to recoup your equity. Without substantial annual appreciation, this situation will not occur, and as mentioned previously, for prices to rise, supply must decrease while demand remains constant or increases.

It should be noted, that favorable Buyer incentives do not typically exist in hot markets because they are not needed. Keep that in mind when making the short term purchase. If you wind up purchasing within an area with substantial inventory, you will experience strong competition when you attempt to sell. Over the past ten years, I have met with many home owners who happily made a home purchase only to find that the neighborhood did not appreciate, and in fact, prices were comparable to when they purchased. Such a situation presents three options. You can sell the property and come out of pocket for the difference at a loss. This sounds awful, but sometimes the loss is still less than the cost to rent. While it may not seem like a win, in reality it is a financial gain. This situation is contingent on your ability to take the necessary monies to closing to finalize the transaction. The second option is to hold the property as an investment for lease. Many clients have investment property portfolios and are quite happy with their growing equity positions and revenue streams. Again, this was not the original plan, but not an awful plan if your loan allows it. Make a mental note to check with your lender to make certain you can lease the property under the terms of your mortgage. Remember with this option, you will need money for your future residence, whether you decide to rent or purchase. The third is to be foreclosed on the property. No one ever wants to go down this road if it can be avoided.

So in conclusion, did I recommend to Buy or to Rent? I recommended neither. Every situation is unique to the person, the location, the property and the current market conditions. What I did provide are the appropriate questions you need answered before you make an educated decision. A good Realtor is worth their weight in gold, and will answer these questions honestly. It is their fiduciary duty to protect your best interests. With that being said, do your homework because just like in any profession we have some lemons as well. You can educate yourself utilizing information from the internet to start a foundation, and having such knowledge will better prepare you to select a great Realtor.

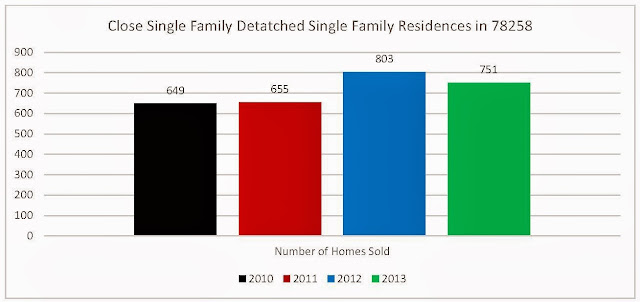

When looking at the closed transactions over the past

three years, July consistently has the largest number of closed transactions,

and they were twice, if not three times the number as the corresponding

January. June is just slightly behind

with August being third for all but one year.

It is important to keep in mind that these statistics are based on the

date the home closed and funded.

Therefore, the homes were escrowed under contract between 30 to 60 days

prior in most cases. With that in mind,

April, May and June are noted as the hottest selling months within the Stone

Oak Area.

When looking at the closed transactions over the past

three years, July consistently has the largest number of closed transactions,

and they were twice, if not three times the number as the corresponding

January. June is just slightly behind

with August being third for all but one year.

It is important to keep in mind that these statistics are based on the

date the home closed and funded.

Therefore, the homes were escrowed under contract between 30 to 60 days

prior in most cases. With that in mind,

April, May and June are noted as the hottest selling months within the Stone

Oak Area.